A genuine NEXO review from someone who has walked the talk. My five-year Journey with Nexo.com

UPDATE: Nexo.com has completely revamped its website to make it more sophisticated and user-friendly. This new look shows how Nexo has grown into a leading digital assets wealth institution. The site now has a clean and simple design, a modern logo, and an easy-to-use interface, all aimed at meeting the needs of smart investors.

I’ve been using Nexo.com since 2020, making it five years now. I am probably going to continue using it for a long time.

I decided to write this review to introduce this platform to anyone who doesn’t know it yet.

I made some mistakes at the beginning and at one point I even withdrew 70% of my deposits from the platform.

I’ll explain why below.

In this Nexo review, I share the details of my personal journey as well as what I like and what I don’t about Nexo.

But first, here’s a quick summary of Nexo.

Quick Summary

Website: Nexo.com

Rating: ★★★★☆ (4.5/5)

Bottom Line: Nexo.com offers an impressive platform for earning high yields on cryptocurrencies, accessing instant loans, and managing crypto investments with ease. While there are a few drawbacks, such as high trading fees and limited collateral options for loans, the overall experience has been positive.

Cons:

- Mandatory KYC process

- High trading fees (compared to other exchanges like e.g MEXC)

- High interest rates on loans (unless a Platinum member)

- Limited collateral options for loans

Pros:

- High yield earnings on stablecoins and cryptocurrencies

- Instant loans without credit checks

- Nexo Card with crypto cashback rewards

- Easy and low-cost withdrawals

- Support for multiple blockchains

- Excellent customer support

- User-friendly app

How it all begun

Five years ago, I discovered Nexo.com and got hooked on their platform for financial gains.

The plan seemed foolproof:

- Buy Nexo Tokens to reach Platinum Level,

- Take out low-interest loans (since my loyalty level would have been a Platinum),

- Let my money earn high interest in my Nexo account.

The goal was to profit from the difference and watch my wealth grow. But life had other plans…

I got caught up in the crypto craze and invested in Fantom, Axie Infinity, and a few others.

Sadly, those choices led to a major downturn, with my investments dropping by 80% to 90% after a couple of months..

I ended up with loans that I’d to repay, but it taught me a hard lesson about crypto market volatility.

Despite the setbacks, I didn’t give up on Nexo. I stayed loyal to the platform, and it paid off.

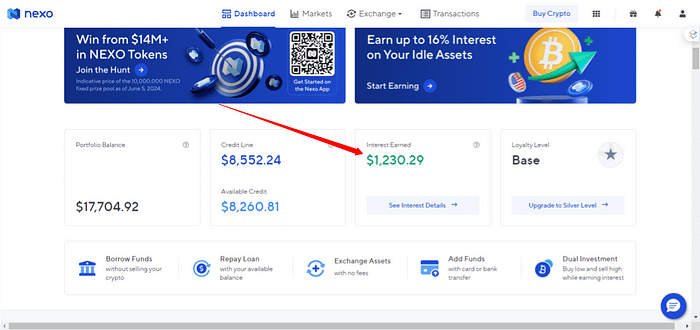

Over the years, my crypto and stable holdings earned me more than $1,229.57 in profit.

The Terra Luna & the FTX collapse

Just when I thought I’d weathered the worst, the collapse of Terra Luna and FTX nearly shattered my confidence in the entire crypto ecosystem.

Terra, once the third-largest cryptocurrency ecosystem, crumbled in just three days in May 2022, wiping out $50 billion.

I lost around $1,500 on Anchor, the protocol at the center of this disaster.

The shockwaves didn’t stop there..

Six months later, FTX, a leading crypto exchange valued at $32 billion, collapsed almost overnight in November 2022.

The fallout was brutal.

- BlockFi filed for bankruptcy two weeks after FTX.

- Three Arrows Capital, another crypto giant, went under due to Terra’s collapse.

- Voyager and Celsius Network followed suit, each succumbing to the same devastating spiral.

I was genuinely terrified. What if Nexo was next?

I withdrew my funds, not willing to take any chances.

But as the dust settled, I found myself redepositing my crypto and stablecoins back into Nexo. Despite the chaos, I’ve stayed with them, placing my trust in their transparency and stability.

For now, they’ve earned my confidence, but I remain vigilant, ever hopeful they’ll stay clear and open with their customers.

Things I don’t like about NEXO 🤔

Alright, enough stories, let’s get down to business.. It’s time to get real about what bugs me about Nexo.

1. You have to do KYC to use their services

One thing that really bothers me about Nexo is the mandatory KYC process to use their services.

I get it, regulations are important, and Nexo needs to comply with the IRS and other tax authorities to operate legally. But still, every time I see that KYC requirement, I cringe.

Taking a photo of my ID and sharing other personal details just doesn’t feel right.

I wish there were a way to use their services without jumping through these hoops.

2. High Trading Fees

The high trading fees on Nexo PRO compared like other crypto exchanges (e.g MEXC) are a major downside.

The costs on Nexo PRO add up quickly, eating into my gains. This is frustrating, especially when there are other options with lower trading fees.

I understand that platforms need to make money, but why are Nexo’s fees so much higher than the competition?

While I’m willing to pay for quality, when the costs start hindering my financial growth, it becomes difficult to remain loyal to the platform.

| Platform | Maker Fee | Taker Fee | Fee Model |

|---|---|---|---|

| Nexo | N/A (0.5-1.2% spread) | N/A (0.5-1.2% spread) | Spread-based pricing |

| Nexo Pro | 0.30% | 0.40% | Tiered volume (0.30%→0%) |

| Binance | 0.10% | 0.10% | Volume/BNB-based tiers |

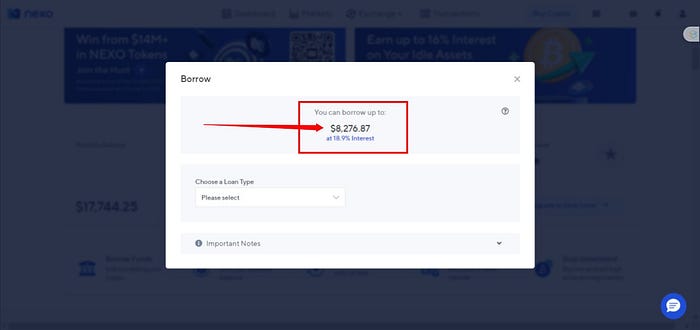

3. They charge a lot of interest for loans

The high interest rates on Nexo’s loans are a major drawback that I find hard to ignore.

If you’re not a Platinum member, you get hit with a staggering 18% interest rate on the borrowed amount. That’s a hefty price to pay for borrowing against your own crypto.

I understand they need to make a profit, but 18%? That’s steep by any standard.

Things I Like about NEXO 😊

Now that we got the “Cons” out of the way, let me tell you the things I do like about NEXO.

1. High Yield Earnings

NEXO stands out with its impressive high-yield earnings on stablecoins, reaching up to 16% APY.

Yes, 16%!

Even without holding their NEXO token, you can earn a solid 9% on your stablecoins. I currently earn 5% on my Euro.

NEXO also offers competitive rates for other cryptocurrencies.

My Bitcoin earns up to 7% APY, depending on my loyalty level, which is based on how many NEXO tokens I hold.

Ethereum gets me up to 8% APY, and XRP can go up to 12%.

These earnings are compounded daily, making my balance grow faster than traditional yearly compounding.

What I appreciate most though is the flexibility.

My crypto aren’t “locked” into staking schemes, so I can withdraw them whenever I want. This freedom to access my funds at any time is invaluable.

With NEXO, I’m investing on my own terms, without sacrificing liquidity for high returns.

2. Instant Loans without credit checks

Although you do need to pass a KYC check for using NEXO, using your crypto as collateral to get an instant loan without a credit check, is a game-changer.

The freedom and flexibility are unmatched. You just deposit your crypto into Nexo, and they quickly tell you how much you can borrow.

For example, when If you put in $10,000 worth of Bitcoin, you could instantly access a loan worth 50% of your Bitcoin’s value.

Nexo’s overcollateralization strategy ensures safety. They make sure every loan is backed by enough collateral.

“Overcollateralization sets Nexo apart from other platforms that might offer riskier loans — and that’s probably the reason why the didn’t collapse like the other Crypto lending platforms back in 2022.”

What I really like is the option to get the loan in USD, either in my Nexo account or my Revolut bank account.

That means, I can use my crypto assets without selling them, keeping my portfolio intact while accessing cash.

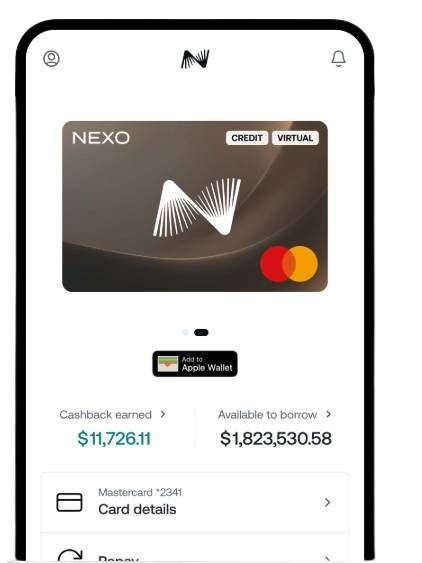

3. NEXO Card

Among the many features I love about Nexo, the Nexo Card truly stands out for its versatility and rewards.

- The fact that it’s a Master Card means it’s accepted almost everywhere, and adding it to my Google Pay was a breeze.

- It’s also compatible with Apple Pay, making it incredibly convenient for on-the-go payments.

- You get up to 2% crypto cashback on every purchase. This feature alone makes the Nexo Card a standout in the crowded field of crypto debit cards.

- Another cool thing about NEXO card is the dual mode functionality.

In debit mode, I spend my crypto, EUR, GBP, or USD seamlessly. It’s like having a wallet with multiple currencies at my fingertips.

In credit mode, I spend without selling my crypto. My deposited crypto acts as collateral, allowing me to borrow against it instantly.

4. Easy Withdrawals

One of the best features that makes my experience with Nexo so enjoyable is the ease of withdrawing funds.

Transferring money to my Revolut Bank account is super convenient.

I’ve done it hundreds of times, and each withdrawal has been smooth and hassle-free.

Also big plus for Nexo is their competitive USD to EURO conversion rate.

It’s consistently two cents better than PayPal’s rate. Over time, this adds up. It’s a small but significant perk that I really appreciate.

Also, withdrawing funds using USDT through networks like Polygon or Arbitrum comes with zero fees.

Yes zero, nada..

5. Supports many blockchains

Nexo’s support for multiple blockchains is another thing I like. It’s not just about Ethereum and its high fees.

With Nexo, I can use stablecoins across different blockchains like Polygon, Tron, and Arbitrum.

I remember cringing at Ethereum gas fees every time I moved money. It felt like a punishment. But with Nexo, I’ve options.

Need to transfer funds? Polygon’s low fees are great. Want to send stablecoins? Tron works well.

Nexo’s variety means I’m not stuck with one expensive choice. I can pick the most cost-effective way to manage my transactions.

6. Extremely good customer support

Nexo’s support for multiple blockchains is impressive, but what truly sets them apart is their excellent customer support.

I’ve been using Nexo for four years, and their support team has always been a lifeline.

Just check what Nexo users say on Trustpilot; it’s not just me who feels this way.

Here are some examples:

Exemplary support: I am not a novice to crypto, but somehow always feel unsure about the steps to take. The support I have been given has been exemplary. Each email has been answered swiftly. Links to useful trainings and information were given in each mail.

[…] They resolved an error on my part when I sent a deposit to the wrong address. I’ve used the lend facility for fiat loans and the money has been in my bank account in 10 minutes. Overall, an excellent all-round service […]

[…] Over the years I’ve had some interactions with costumer service. They responded very fast, are super friendly aswell as professional […]

[…] Thank you to the customer support that help me to recover my 2FA and access to my account in less than 24h […]

With over 7 million users and a 4.7-star rating on Trustpilot, the numbers don’t lie.

“One personal incident that stands out is when a friend of mine made a mistake and sent me around $400 of USDT using a non-supported network about two years ago. We eventually lost the money, but the Nexo support team was there every step of the way. They were very responsive and empathetic, walking us through all possible solutions and ensuring we understood the limitations.”

In a world where customer service often feels robotic and distant, Nexo brings a comforting human touch.

7. You can buy Crypto with Visa

Another thing I like is the ability to buy crypto seamlessly with my Visa card.

It’s one of those conveniences that genuinely makes life easier. Who wants to jump through hoops just to make an investment? Nexo allows me to use my Revolut card to buy crypto directly, and it’s as simple as it sounds.

Nexo’s streamlined approach to buying crypto is a major win in my book.

8. They take things seriously

When it comes to security and reliability, I appreciate that Nexo takes things seriously.

Their strict collateralization rules stand out to me. They only let users borrow what they can afford, and if someone fails to pay their debt, smart contracts automatically liquidate the borrower’s crypto assets.

This system protects lenders and ensures the platform runs smoothly.

Nexo’s commitment to global licensing also impresses me. They’ve worked hard to obtain a wide range of licenses, complying with all relevant regulations.

Collaborating with top legal experts and engaging with regulatory authorities, Nexo ensures their products are sustainable for the long term.

“If someone fails to pay their debt, smart contracts automatically liquidate the borrower’s crypto assets”.

Insurance is another key part of their security framework. Through partnerships with custody providers like Ledger Vault and Fireblocks, Nexo offers extensive insurance coverage on custodial assets.

They’re supported by well-known underwriters such as Lloyd’s of London and Marsh & Arch.

Knowing that my assets are insured gives me peace of mind and strengthens my trust in the platform.

9. I like their app

Nexo’s app is a game-changer for managing my crypto portfolio on the go. It’s well-made and incredibly user-friendly.

From my first login, navigating the features felt natural. There’s no learning curve — just smooth sailing.

The app has no bugs or lag issues. I’ve used other crypto apps before, and nothing is more frustrating than constant crashes or slow performance.

With Nexo, I’ve never faced such problems. Everything works seamlessly.

Final Words

After five years, Nexo.com has truly exceeded my expectations. Despite initial fears with the Terra Luna and FTX collapses, the platform’s benefits far outweigh its drawbacks.

High-yield earnings, instant loans, and the versatile Nexo Card make managing crypto investments a breeze.

The customer support is excellent, and the app’s user-friendliness keeps me on top of my portfolio effortlessly.

Overall, Nexo.com is a reliable and indispensable tool for my crypto journey.

✅ CLICK HERE TO CREATE A FREE NEXO ACCOUNT

What do you think about NEXO? What is your experience with the platform? Leave your review in the comments section and explain what do you like the most and what the least.

👉 Aκολούθησέ με στο Facebook και ενεργοποίησε τις ειδοποιήσεις για να λαμβάνεις τα νέα άρθρα μου.