In today’s article, I will explain how you can invest your money. I’ll go through 9 proven ways to invest your money—mostly online—with the lowest risk possible.

Please note that I am not an investment advisor. I just like to explore this particular topic. The following investment recommendations are either ones I have used in the past, use now, or want to try in the future.

Before I move on to the ways you can invest your money, it is important to understand what passive investing and active investing are, as the investment ideas I explain below fall under passive investing.

What is passive investment and what is active investment?

To explain it as simply as possible:

Active investment = personal work and business risk.

Passive investment = efficient use of capital.

For example, when you decide to open a shop, you invest your money actively. You have to be there, run the business, and work to make it successful. That’s active investment.

But if you invest in dividend-paying shares (i.e., shares that pay dividends), you are investing passively. You don’t have to be there, you don’t have to work, and you don’t bear the risk of the business not succeeding. That’s passive investment.

With active investment, your money may have a higher return, but you have a higher risk. With passive investment, you may have a lower return but less risk.

Where to Find the Money for Investments

Now, to invest, you need to have money. But where do you get the money to invest?

If you don’t have capital, you have to build it up slowly. Many investment “gurus” say you have to pay yourself first, and they are right.

What do I mean by paying yourself first?

For example, if you have an income of 1,000 euros, you should always set aside at least 10% for investments. That means paying yourself first and then covering other expenses.

With the remaining 90%, you will pay your obligations and manage your monthly expenses.

So, assuming you invest 100 euros per month, over time, your capital will start to grow.

It may seem like a small amount at first, but you must do this to build the right mindset and make it a habit.

As your income increases, you will save more, invest more, and your wealth will grow faster.

Now that we’ve covered that, let’s look at how to invest your money.

How to invest my money

Below are the different ways to invest your money. I will give you some basic information about each method. However, you should STUDY the method you choose to invest your money and understand the pros and cons of each method.

1. P2P microloans

- Accessibility: Easy

- Risk: Medium

- Yield (APY): 5% – 10%+

- Thwarted Capital: Low

P2P microloans are an excellent option for those looking to start their investment journey.

P2P microloans are a form of online lending where individuals can lend money directly to borrowers, usually through an online platform.

These loans are relatively small, ranging from a few hundred to a few thousand dollars, and serve as an alternative to traditional bank loans.

Borrowers apply for these loans and individual investors like me can fund these loans in exchange for interest payments.

😁 Advantages:

- Diversification: P2P microloans offer you the opportunity to diversify your investment portfolio. You can spread your investment across multiple loans to reduce risk.

- Accessibility: It’s relatively easy to get started and you don’t need a lot of capital.

- Higher yields: Compared to traditional savings accounts, P2P microloans offer higher returns.

🤔 Disadvantages:

- Danger: There is a risk that borrowers will default on their loans, which can lead to losses for investors.

- Lack of liquidity: Your money is tied up until the end of the loan term.

- Limited setting: P2P lending platforms can have varying degrees of regulation, so it’s important to choose a reliable platform.

How to get started

The only platform that I have tried and still to this day invest money in is Mintos. Mintos brings under its umbrella various companies that offer microloans. Thus, it enables investors to access all these microloans through its platform.

I personally recommend Mintos to start investing in P2P loans for several reasons:

- Different loan options: Mintos offers a wide variety of loan types, including personal loans, car loans and more. This diversity allows you to invest in loans based on these criteria.

- Automatic lining function: Mintos provides an auto-investment feature that helps you automate your investments based on your criteria, making it beginner-friendly.

- Secondary market: Mintos also has a secondary market where you can sell your loans if you need liquidity before the maturity of the loan.

- Transparency: Mintos provides extensive information about the lending institutions and their track record, helping you to make informed investment decisions.

- Buy back program: this means that if a borrower defaults on a loan, the lender buys it back, reducing the risk for investors.

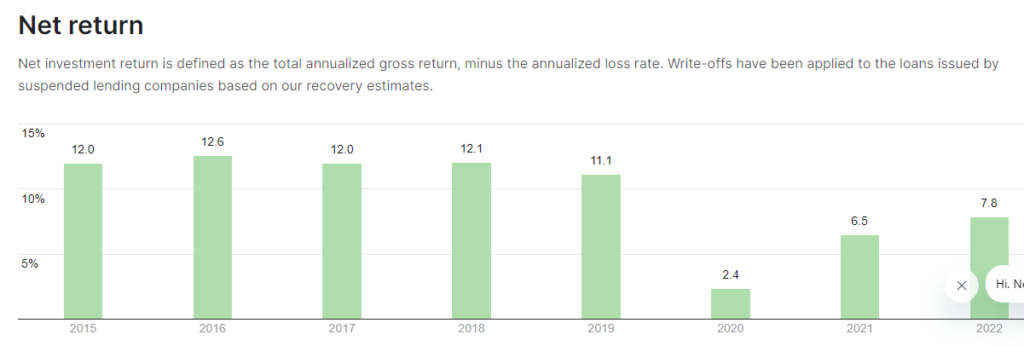

- Almost 10 years of experience: Mintos has been online since 2015 in the P2P lending sector, proving stability and reliability.

- Mobile app: Mintos also provides a mobile app to view your investments wherever you are.

In general, investing in microloans – especially through Mintos – is a method that requires low capital to get started, is relatively safe and offers high returns.

2. Mutual Funds

- Accessibility: Easy

- Risk: Low

- Yield (APY): 5% – 15%+

- Thwarted Capital: Low

Mutual funds are an easy way to invest your money. Imagine that you and a group of friends decide to pool your money to buy a variety of investments, such as stocks, bonds or other assets.

Each person in the group owns a share of this common investment pool, and the value of their shares goes up or down depending on how well the investments perform.

What are mutual funds?

Mutual funds raise money from many investors like you who want to increase their wealth.

These funds are managed by experienced professionals who make investment decisions on behalf of all investors. These experts aim to make your money grow by choosing the right mix of investments.

Mutual funds distribute investors’ money across a wide range of “products”. This means that risk is spread, as opposed to investing all your money in just one stock or class.

There are different types of mutual funds, each with its own risk and return profile. For example, equity funds invest in stocks, while bond funds focus on bonds.

For example, the S&P 500 is a well-known index that includes the 500 largest companies in the US. If you invest in an S&P 500 index fund, you are essentially investing in these 500 companies all together.

The nice thing is that index funds are usually low cost and easy to understand. They are not managed by someone trying to pick the best stocks. Instead, they just follow the index, so when the index goes up, your investment goes up, and when it goes down, your investment goes down.

It is a good option for new investors because it is simple and can be a safer way to get started in the stock market. It’s like dipping your toes in the water before you “dive” into more complicated things.

How to get started

You can start investing in mutual funds through Revolut. The process is extremely simple.

First, download the Revolut app and create your account. Once you’ve arranged all the KYC (Know your customer) you need, you’ll have access to Revolut’s investment features.

Revolut stands out due to its partnership with the Fidelity group (well known in the global investment community), and offers access to a range of Fidelity funds directly from the app. This, greatly simplifies the process of investing in mutual funds.

You can start investing with as little as 10 euros with an annual percentage yield (APY) starting from 3.03%. This means that an investment of 10,000 euros will give you a return of around 300 euros per year.

3. Invest in ETFs

- Accessibility: Easy

- Risk: Low

- Yield (APY): 5% – 15%+

- Thwarted Capital: Low

ETFs, or Exchange-Traded Funds, are like investment packages. Imagine you’re at a buffet and instead of choosing just one dish, you can get a plate with a mix of different foods.

Well, ETFs do something similar to stocks or bonds. They “package” a group of them together into an investment option.

So when you invest in an ETF, you are spreading your money across several assets at the same time, which can help reduce risk and give you a more diversified portfolio.

In addition, you can buy and sell ETF shares on the exchange, which makes them quite convenient for ordinary investors.

How to get started

If you want to invest in ETFs, start with Freedom24 or Degiro. These are reliable platforms for buying and managing your ETF investments. Just sign up, deposit your money, search ETFs and start investing.

4. Invest in REITs

- Accessibility: Easy

- Risk: Low

- Yield (APY): 4% – 10%+

- Thwarted Capital: Low

Consider that you want to invest in real estate, but you don’t have the money to buy a whole building. Real Estate Investment Trusts, or REITs, are a way to invest in real estate with a group of people. When you buy shares in a REIT, you’re actually investing in a large group of properties, such as apartment buildings, shopping centers or office space.

The nice thing is that REITs are required by law to pay most of the rental income to their investors. So when you own shares in a REIT, you can receive a share of that income (from rents) in the form of dividends. It’s kind of like collecting rent without being a landlord.

Also, REITs are usually traded on stock exchanges, so you can easily buy and sell them – just like regular shares. This makes it simpler to invest in real estate. You don’t need a ton of money or to be involved in real estate to get started.

Just keep in mind that the value of the REIT – since it is traded on the stock exchange as well – can go up or down. Of course there are REITs whose price is not traded on the stock exchange, but I’ll leave that for another article.

But beyond that, it’s a way to get into the real estate game without owning an entire building yourself.

How to get started

You can invest in REITs through the Crowdbase platform. Open an account and explore the investment opportunities available.

5. Invest in online properties

- Accessibility: Medium

- Risk: Medium

- Yield (APY): 3% – 5%+

- Thwarted Capital: Tall

One of the best online investments is to buy assets that are already generating money. For example, a blog or a YouTube channel that makes money from advertising.

For example, if a website earns 100 euros a month from various methods and you buy it for 1000 euros, you will earn your money back in 10 – 12 months and then it will continue to generate profit.

Not to say that, if you spend some time on it building backlinks or putting in more content, your revenue will probably increase and as a result you will recoup your investment faster.

This can be done with a YouTube channel or any online tool that makes money.

How to get started

You can get started with this method of investing by going to Flippa, a website where you can find online “real estate” such as websites and YouTube channels for sale.

It’s like buying an existing online business that’s already making money, and then you can make it more profitable by running ads or selling products related to its theme.

It’s a way to invest in the online world without starting from scratch.

6. Cryptocurrency staking

- Accessibility: Medium

- Risk: Low

- Yield (APY): 3% – 10%+

- Thwarted Capital: Tall

Cryptocurrency staking is a process in which you “lock” your cryptocurrency (their “stake”) to support the security and operation of a blockchain network.

When someone “locks up” their cryptocurrency, they are essentially helping to secure the network and validate the transactions that take place on it. This is done through a “consensus mechanism” called Proof of Stake.

To learn more about Proof of Stake and how this method works, you can watch this video. It’s not the best, but it’s the only one in Greek.

How to get started

First you need to buy a cryptocurrency that uses proof of stake. Not all cryptocurrencies offer this feature. Some good options are Ethereum, Cardano, Tezos, Cosmos and Solana.

You can buy them from Exodus Wallet which is one of the best and safest in my opinion.

Exodus Wallet lets you buy the above cryptocurrencies with a card and stake them with the click of a button.

7. Become a Crypto Miner

- Accessibility: Difficult

- Risk: Low

- Yield (APY): –

- Thwarted Capital: Medium

Investing in Bitcoin mining is like becoming part of a special team that helps produce more Bitcoins.

To get started, you need a computer with good power and a stable internet connection. Then you need to install special software for mining. This software helps your computer solve math problems and when it solves a problem, it rewards you with new Bitcoins.

Once you have everything installed, you can start mining. Your computer will join a large group of other miners and together you will work to solve these mathematical problems. When one of you solves it, the team gets some new Bitcoins and you get your share depending on how much you’ve contributed.

That’s the basic idea.

However, Bitcoin mining nowadays requires special equipment, such as powerful computer machines called ASIC miners. These machines are much more efficient at solving mathematical problems compared to regular computers – because they are built to do just that – nothing else.

These machines are very expensive, ranging from 1000 euros to 20 thousand euros – depending on their mining power – and consume a significant amount of electricity.

The cost of mining also depends on your location and electricity prices. Some places have cheaper electricity, which can make mining more profitable. However, without specialized equipment and access to low-cost electricity, it can be difficult to turn a profit.

You’ll also need people who know how to install things. For this, this method is not very popular.

But one thing is for sure… You will end up making Bitcoin passively and with the upcoming price appreciation (somewhere around 2025 I believe) you will make a solid profit on your initial investment).

8. Invest in Crowdfunding Real Estate

- Accessibility: Difficult

- Risk: Low

- Yield (APY): 3% – 5%+

- Thwarted Capital: Low

Another popular and easy-to-start investment method is real estate investing through crowdfunding platforms.

With just €100, you can start investing in real estate around the world.

Real estate crowdfunding is a simple process where real estate projects are listed on dedicated websites. These projects are carefully examined by the experts on the websites to ensure that they are legitimate and that those who receive the money are real entrepreneurs and not scammers.

Investors from all over the world have the opportunity to invest any amount they like to support these projects.

Essentially, it’s like giving crowdfunded loans to companies in the real estate sector. The potential returns are quite attractive, usually averaging around 10-15%.

This method allows you to dip your toes into the real estate market without having to invest a significant initial sum.

How to get started

To get started, go to Crowdestate, create an account and start studying the platform and the properties available for investment.

9. Invest in dividend-paying stocks

- Accessibility: Easy

- Risk: Low

- Yield (APY): 3% – 5%+

- Thwarted Capital: Low

Dividend-paying shares are shares of companies that decide to distribute a portion of their profits to their shareholders. Dividends are a way for investors to receive additional passive income from their investments.

Some stocks that pay dividends are Coca Cola, General Mills, Exxon Mobil, etc. If you dig around, you’ll find that there are thousands of companies that pay dividends to shareholders, and some of them have been paying dividends every year for over 100 years.

How to get started

- Open an account with Degiro: You will need an account with a brokerage firm or an online investment platform like Degiro.

- Set your budget: Determine how much money you’re willing to invest in stocks. It is important to have a clear plan for your budget.

- He chose shares: Look for companies that pay dividends and that interest you. You can research stock returns, their history, and their prospects.

Final Words

To start investing for a better future, you don’t need a lot of money. You need discipline and consistency. Even with a little money every month, you can make a good fortune after a few years.

See also

👉 Aκολούθησέ με στο Facebook και ενεργοποίησε τις ειδοποιήσεις για να λαμβάνεις τα νέα άρθρα μου.