Investing in cryptocurrencies has become a popular way for people to diversify their investment portfolio and make potential profits.

However, with so many cryptocurrencies available out there, it can be difficult to determine which ones are worth investing in and which ones are not.

In this article, I will answer the question “What are the best cryptocurrencies to invest in” based on my experience in the field and the usefulness of each one.

☝️ If you are looking for the next 1000X meme-coin I will disappoint you. You won’t find anything like that in this article.

Also, I want to clarify that the cryptocurrencies you will see below will not make you rich overnight. DO NOT get “seduced” by gurus or the next crazy meme coin that will give a 1000X return in 1 month. This is like betting. One time you’ll win and many times you will lose.

Investing in cryptocurrencies has risks and you should only invest what you can afford to lose.

Furthermore, I must tell you that I am not a financial advisor and will not be held responsible for any losses that may result from your actions. I am just a blogger – a random guy on the internet – who publishes his thoughts online.

Best Cryptocurrencies For Investment

Now, let’s see which are the best cryptocurrencies to invest in.

Note: I have investments in all of the following cryptocurrencies.

1. Bitcoin (BTC)

The first cryptocurrency on this list is Bitcoin. Yes, despite what everyone says, it is indeed the best and safest investment in my opinion.

It is widely recognized as the “gold” of cryptocurrencies and has a long history as a reliable store of value – just like gold.

I believe that Bitcoin will continue to be a key asset for people who want to protect their wealth in the new global digital economy we are moving towards.

Also, its limited circulation (21 million Bitcoin only) and its increased demand (especially now that the global economy is going from bad to worse) makes me believe that its value will skyrocket in the coming years and will surpass its all-time-high of 60,000 euros.

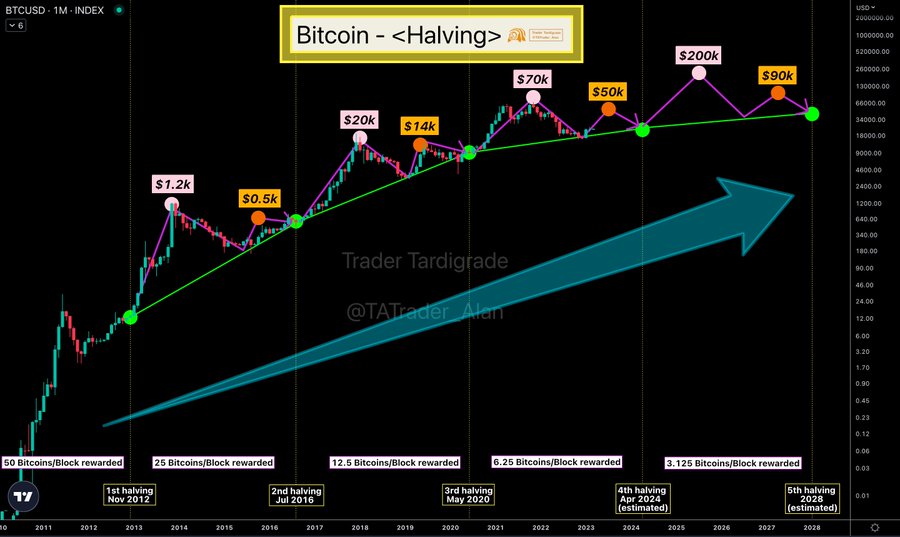

Let’s not forget also the upcoming halving that will take place in 2024 which reinforces my view. Just for information, the price of Bitcoin goes up after each halving.

2. Ethereum (ETH)

Ethereum is the second most popular cryptocurrency and is often referred to as the software on which the new global economy will be built.

Ethereum has become the “platform” that allows developers to create decentralized applications (DApps).

Simply put, it’s a platform that provides the code and tools to build programs.

Ethereum’s smart contracts functionality allows developers to create automated contracts that execute when certain conditions are met.

This feature makes Ethereum a flexible platform for building a wide range of DApps, including decentralized financial (DeFi) and non-fungible tokens (NFTs).

My view is that Ethereum is too big now to fail. I also believe that no matter how many new blockchains and “ethereum-killers” come out, they will never be able to catch up.

Ethereum is only on an upward trajectory and its price is still relatively low.

3. Hedera Hashgraph (HBAR)

Hedera Hashgraph is a third-generation blockchain that aims to improve on the limitations of previous blockchain technologies.

Unlike traditional blockchains that rely on a proof-of-work (PoW) or proof-of-stake (PoS) consensus mechanism, Hedera Hashgraph uses a consensus algorithm called Hashgraph.

This algorithm allows for faster transaction times, increased scalability and better security.

Personally, I have been investing in Hedera for many years because:

- If you study its technology a little bit you will see that it is unique. Watch this video. 👇

- The speeds and the number of transactions it can run simultaneously far exceeds that of Ethereum and even Visa.

- Transaction fees are cheap. They are approximately $0.001 per transaction.

- It is constantly on the rise in both users and transactions through its technology.

- Hedera Hashgraph is “managed” by well-known organizations around the world such as DELL, Google, IBM, LG, UBISOFT and many others.

With all of the above, and with such a low price that you are trading Hedera at the moment, I feel it is a sin not to have it in your portfolio. I believe Hedera will explode in the next bull-run (which is coming).

4. Polygon (MATIC)

Polygon is a “level 2 scaling solution” for Ethereum. It aims to solve Ethereum’s scaling problems, allowing for faster and cheaper transactions.

It is essentially built on top of Ethereum and allows developers to build their programs with the tools and security that Ethereum offers but with faster and cheaper transactions.

Polygon has gained significant attention in recent months and has worked with major players such as Warner Group, Facebook, Disney and Starbucks.

These partnerships demonstrate the potential of the platform. I’m sure you understand that these organizations do NOT make their choices by accident.

And if all these organizations that build products with Polygon imagine what will happen in terms of the price of interest.

5. Gala Games (GALA)

Gala Games is a game studio that has created several functional games that use blockchain technology to store the data and NFT generated in their games.

Although there are hundreds of gaming startups that promise to make the next gaming-hit or Gala Games is the only one that managed to have games that are already played by hundreds of thousands of people around the world.

Indicatively some of the games of Gala Games that have received significant recognition are TownStar and Superior.

The Gala doesn’t stop here though. Gala Films is in the works with several productions in the pipeline and Gala Music is hoping to build a decentralized Spotify.

This whole ecosystem works with the GALA Token. The company still has a long way to go. I’m just confident that the price of the token will skyrocket as more and more new partnerships are announced and the demand for the Gala Token increases.

6. Cosmos (ATOM)

Cosmos is a platform that aims to connect all blockchain chains together.

The interoperability offered by the platform allows different blockchains to communicate with each other, enabling better collaboration and seamless transactions between networks.

For example, if you want to send your Ethereum from a wallet that only supports Ethereum Network to a wallet that only supports Tron Network you cannot. If you do, your Eth will be lost.

But there are wallets that allow you to send tokens from any blockchain and receive them in your wallet. 90% of wallets or Dapps that have this feature use the technology offered by COSMOS.

So, the COSMOS network – as I see it at least – has become the go-to-place if you want to add interoperability to your blockchain or Dapp. This fact encourages me to increase my investment in ATOM and recommend it in my articles.

7. Theta Network (THETA)

Theta Network is a blockchain with a focus on video, media and entertainment. The platform aims to improve the quality of video streaming and reduce costs by using a decentralized network of nodes to distribute video content.

Theta Network has already partnered with several high-profile companies in the media and entertainment industry, including the World Poker Tour, Samsung, Sony and MGM Studios.

The innovative technology it offers and the platform’s partnerships with entertainment industry giants position it well for future growth in the media and entertainment industry.

Also, with a value of less than one euro per THETA token, I think it is one of the “little diamonds” worth investing in.

8. Monero (XMR)

You’ve definitely heard of Monero before. The difference between this cryptocurrency and Bitcoin and any other cryptocurrency that exists at the moment is that transactions made with Monero cannot be tracked in any way.

Now you will say to me “and why should I invest in this cryptocurrency”?

The reason is simple – although it may sound frivolous.

Just as I believe that Bitcoin will be the gold standard in the new global economy they are promoting, so too will Monero be the medium of exchange for those who want to make untraceable transactions.

Now you’re going to say “who are the people who want to make trades that are not detected?”

The mafia, the banks (yes, the banks), the rich, companies that want to hide profits from governments, politicians who want to hide their backgrounds, etc.

Until now, they would have to set up offshore companies, write off assets left and right (all those Panama papers you hear about) to hide their wealth.

Monero will be their medium of exchange to hide their transactions in the world of cryptocurrencies and blockchain technology.

Let’s not forget that blockchain technology stores every transaction forever. You won’t be able to hide anything. All transactions will be seen and stored on a blockchain.

Those who want to bring us the new global economy (meanwhile I realize that I may sound like a co-communist – but I don’t care), want to have a way to transact without being able to link a transaction to the identity of the person doing it.

Monero has been around for over a decade and they haven’t stopped it. I wonder why?

Anyway, the value of Monero as well as the other cryptocurrencies on this list I believe will skyrocket in the near future.

Tips for investing in cryptocurrencies

Investing in cryptocurrencies can be exciting, but it’s important to do it wisely. Here are some tips that can help you make the right investment moves:

- Invest 10% of your income per month first: As with any investment, it’s important to have a budget and stick to it. Consider setting aside a portion of your income each month to invest in cryptocurrencies. A general rule of thumb is to invest no more than 10% of your monthly income. This way, you can gradually build your portfolio without compromising your financial stability.

- Don’t keep your cryptocurrency in exchanges: While exchanges are convenient for buying and selling cryptocurrencies, they can be vulnerable to hackers and security breaches. As a general rule, it’s best to transfer your cryptocurrency to a self-managed wallet that you control. That way, you have full control of your assets and can protect them from potential security threats.

- Dollar Cost Averaging: dollar cost averaging is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market ups and downs. Using this method you don’t worry about when to buy as you buy every month, regardless of the price.

- Study well the crypto you invest in: Before investing in any cryptocurrency, it is important to do your research and understand its fundamentals. What can you do? Follow the news around it, follow their social networks and turn on notifications, follow their CEO and developers.

- Watch the price: While it’s tempting to hold your investment forever and not sell, it’s important to take profits when the time is right. Watching the price and selling and taking profits when the market goes up will help you minimize risk and maximize your returns.

- Don’t invest more than you can lose: Investing in cryptocurrencies carries risks and it is important to invest only what you can lose. If you follow my previous advice to invest only 10% of your earnings each month, you’ll never fall into that hole.

- Consider the long-term possibilities: While short-term gains from meme coins are always tempting, it is important to consider the long-term potential of your investments. Focus on cryptocurrencies with strong fundamentals and long-term growth potential, rather than those that promise quick gains.

Click here to read my article on how to invest in cryptocurrencies safely.

Final Words

These are my top picks for the best cryptocurrencies to invest in based on their usability and growth potential – and what I think, being just a blogger.

However, investing in cryptocurrencies has many risks and it is important to do your research before buying anything and only invest what you can afford to lose.

Furthermore, I want to reiterate that I am not a financial advisor and you should consult a professional before making any investment decision.

See also

👉 Aκολούθησέ με στο Facebook και ενεργοποίησε τις ειδοποιήσεις για να λαμβάνεις τα νέα άρθρα μου.