In this article I give you 9 TESTED passive income ideas from the internet.

What do I mean by “tried and tested”…

But of course I’ve tried them in the past or I still use them today.

Passive income is a great way to generate extra income without having to lift a finger. With pandemic, inflation and digitization threatening everyone’s income, creating multiple sources of income is imperative.

It will help you to become more financially independent and will bridge the gap that will be created in your finances if the boss suddenly calls you in his office(certainly not for a raise)..

But I warn you… Passive income is usually built up through large capital investments. If you don’t have the large capital, you can invest a little bit of money every month. In some cases, you’ll need to spend a lot of time building up what will generate passive income first.

What is Passive Income?

Before I move on to the ideas of passive income, I think it is right to clarify what this term means.

Many people confuse the term passive income in their minds. They think that passive income means money from nowhere.

This is completely wrong.

Passive income is when you “build” something that can make you money even when you are not there or with little or no work.

But you have to build it first to produce passive income. Usually to build that something, it takes effort, time and sometimes money.

9 Ideas for Passive Income from the Internet

Now that we have clarified what passive income is, let’s move on to passive income ideas.

1. Peer-to-peer (P2P) loans

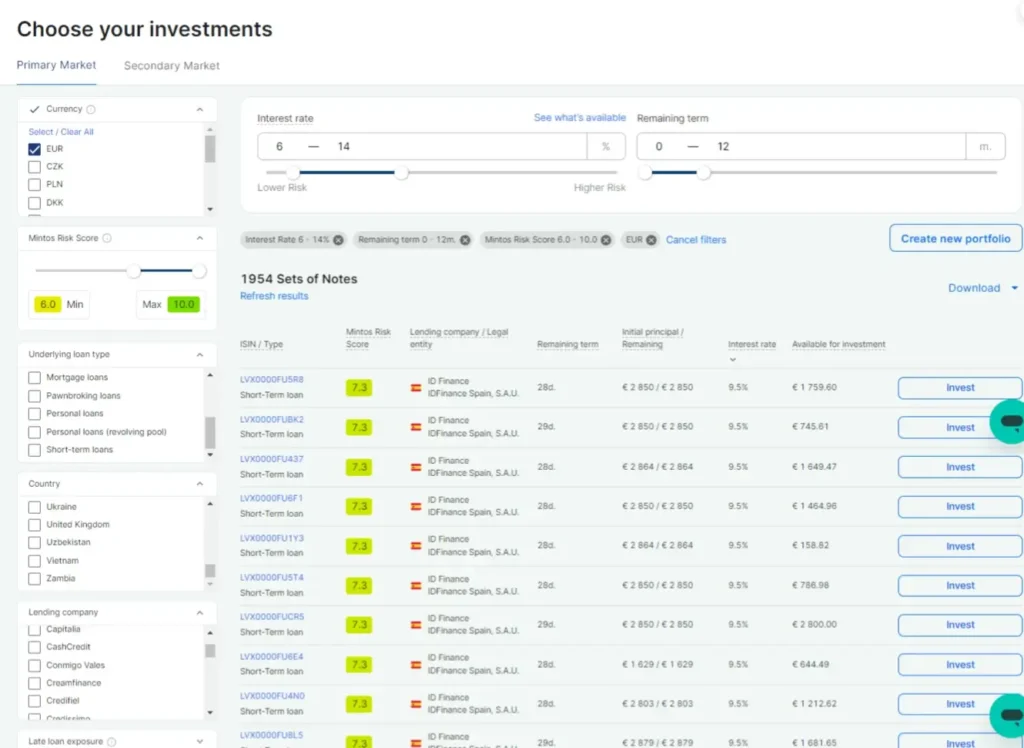

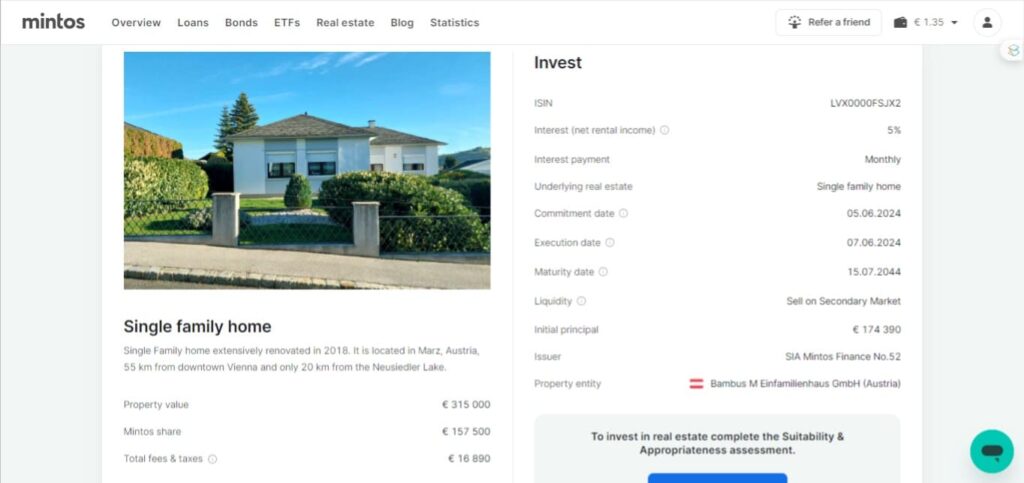

A peer-to-peer (P2P) loan is a personal loan given by a community of lenders (including you) to a borrower, through platforms such as Mintos.

These platforms act as the intermediary that “controls” both parties (the lender and the borrower) and provide the “working environment” to process these transactions.

The procedure is simple.

- Someone needs a microloan – e.g. €1000. He doesn’t want to get it from a bank because the bank needs an account, paperwork etc..

- It goes to one of the microloan companies that work with Mintos.

- Once approved, his loan will appear on the Mintos platform and will be funded by thousands of investors around the world, who can invest from as little as €10.

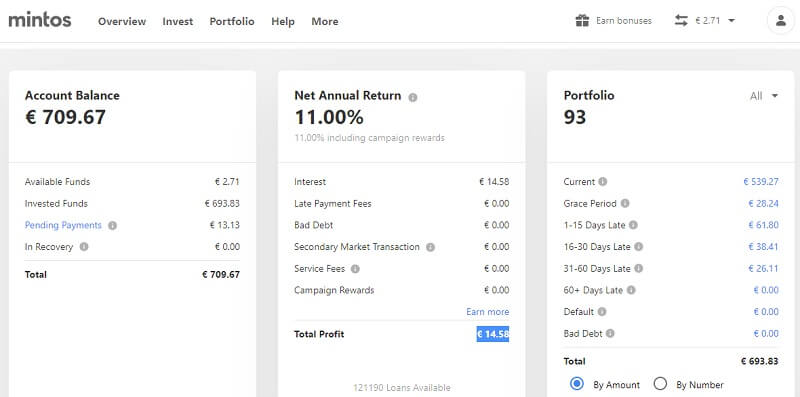

- The investor’s profit starts from 11% – 14% per year, which is a very high return. In short, if you invest €1,000 in microloans, at the end of the year you will have €1,110 in your account.

Of course, to be able to earn a passive income of €200 per month, it means that you need to have around €20-25 thousand invested in microloans. I know it’s a lot, but not impossible. Personally, I’m determined to achieve it.

I personally invest in Mintos around 100 – 150 euros per month. This company is one of the most well-known and reliable.

In addition, it guarantees that it will buy back the loans that may not be repaid by the borrowers and return the money to the borrowers.

2. Park your money with Revolut

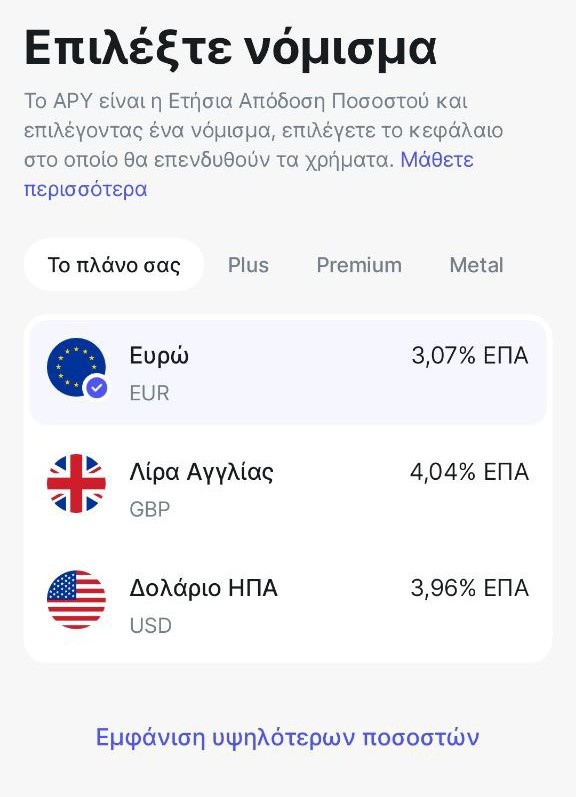

One of the easiest ways to have passive income is to simply park your money in Revolut.

Revolut is one of the best known “Neo-Banks” in Europe. It has a bank license and protects deposits up to 100.000 euros – like “normal” (so to speak) banks.

Revolut, gives you the opportunity to open a savings account which will give you a return of 3.07% per year (as of writing this post).

Now you’re going to ask me, why Revolut and not another bank?

- I personally use Revolut and trust it

- Banks (at least in Cyprus, at the time of writing this article, do not give ridiculous returns)

- You do everything from your mobile phone. You don’t have to talk to anyone,

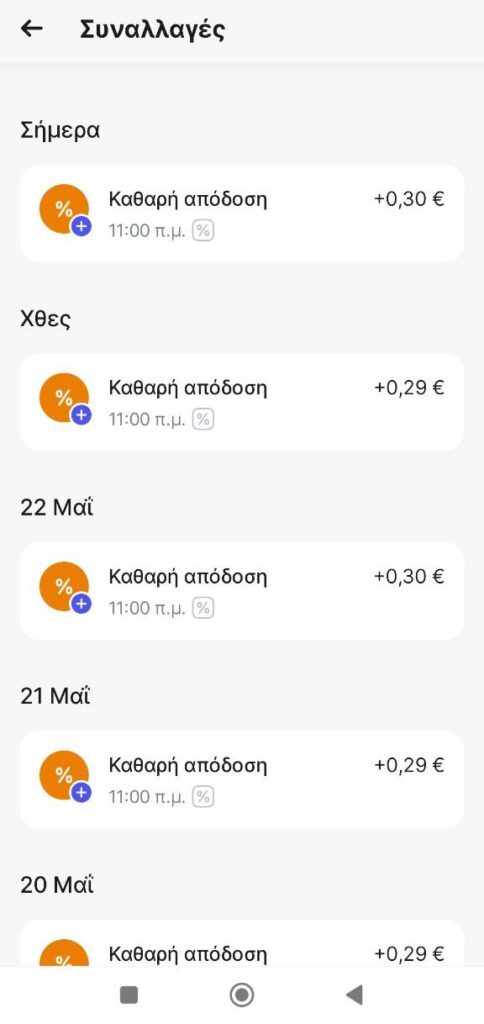

- Performance is entered into my account on a daily basis (and I like to see it).

- You can withdraw them from the savings account at any time.

- You have your card where you can spend your money whenever you want.

In short, to earn €100 a month from this method, you need to park 40,000 euros. Your return will be €1,247 per year or €3.41 per day.

3. ETFs

ETFs, or Exchange-Traded Funds, are a kind of basket of stocks that you can buy and sell on the stock market, just like individual stocks.

In my opinion they are very good because they allow you to invest in several stocks at the same time without having to buy each one separately.

ETFs are a good way to start investing, especially if you’re new to it. Instead of trying to pick individual stocks, which can be difficult, you can buy an ETF that includes several stocks. This helps to spread the risk.

For example, if a company in the ETF does not do well, it may not affect you as much because other companies in the ETF may do better.

- A good option to buy ETFs is Revolut – mentioned before. Through its app you can buy and sell shares and ETFs. It’s easy to use and you can start investing with a small amount of money.

- Another place to check is Mintos – which I mentioned at the beginning of the article. Mintos is mainly a platform for investing in loans, but it has started to offer ETFs as well.

- Then there is Freedom24, which is another excellent platform for buying ETFs. It is part of Freedom Finance and offers a wide range of ETFs to choose from. Personally, I like it because it provides a lot of information about each ETF, which helps me make better decisions.

The return you can get from an ETF depends on a number of factors, such as the type of ETF and market performance. Generally, the yields are quite high.

For example:

- SPDR S&P 500 ETF (SPY): this ETF tracks the S&P 500 index, which includes the 500 largest companies in the US. It is very popular and is considered a stable investment. The SPDR S&P 500 ETF (SPY) has averaged a return of 12.30% per year over the last 10 years. [1]

- Vanguard Total Stock Market ETF (VTI): this ETF tracks the entire U.S. stock market. Personally, I find it a good choice for investing in a wide variety of companies. The Vanguard Total Stock Market ETF (VTI) has averaged a return of 12.27% per year over the last 10 years. [2]

- iShares MSCI Emerging Markets ETF (EEM): this ETF invests in developing markets. The ETF’s average annual return over the last 10 years is 2.26% [3].

- Invesco QQQ (QQQ): tracks the Nasdaq-100 index, which includes mainly technology companies. If you believe in technology growth, this ETF may be of interest to you. The Invesco QQQ (QQQ) ETF’s average annual return over the past 10 years is 18.58% [4].

4. Real estate securities / crowdfunding

For those of you who understand how real estate can generate passive income, but don’t have the required capital, you might want to consider real estate crowdfunding.

It’s like joining a group of people to buy a property. Instead of owning the whole building or land, you just own a small part of it.

This way, you don’t need to have tons of money to get started.

You can invest smaller amounts on a monthly basis and still earn from the rent or the increase in the value of the property. It’s a great way to get into the property market without the hassle of property management and without a lot of capital.

There are various online platforms that offer this.

Mintos (which I mentioned earlier) is one of them. It makes it easier for you to start investing with smaller amounts.

Another good one is Fundrise, which allows you to invest in a variety of properties.

RealtyMogul is also popular and has different options depending on what you are looking for.

These platforms make it simple to start investing in real estate and can help you increase your passive income.

5. Traffic arbitrage

Traffic arbitrage is a way to make money on the internet by buying cheap traffic (website visitors) and earning more than what you spent from the ads that appear on your website.

Example: if it costs me €1 to send 1000 visitors to my website but I earn €1.50 per 1000 visits, then I earn €0.50 per thousand. If I buy 200 thousand visitors (i.e. spend €200) and make €300 from advertising, then I earn €100 without doing anything.

The idea is to spend less to bring in than you earn from clicks on ads.

Here’s how you can do it:

Create your Blog:

- Pick a niche topic that interests you and you can write a lot about it.

- Build your blog.

- Choose a catchy and relevant domain name from Namecheap.

Choosing the wrong niche can lead to low profits. It is important to do proper research to choose the most appropriate and profitable niche. For this you can use a keyword research tool – like Semrush – that shows you the average CPC an advertiser pays for each keyword.

Creating Content:

- Write interesting and useful articles regularly. Hire writers from Fiverr or use AI tools to produce quality articles for each blog.

- Focus on topics that can attract many readers and have good advertising revenue potential. (e.g. Finance, Health, Business, Law, Investment, Medical, etc.).

- Make sure your content is original and engaging.

- Implement SEO practices to help your blogs rank better in search engines.

Application to Advertising Networks:

- Apply to Google AdSense to display ads on your blog.

- You can also consider other advertising networks such as Media.net or AdSterra.

- Make sure your blog meets their requirements for approval.

Buy Visibility:

- Sign up to advertising networks such as Revcontent, Taboola or MGID.

- Create advertising campaigns targeting your audience.

- Spend small amounts at first to see what works best.

Send Visitors to your website:

- Direct purchased traffic to your blog articles.

- Track which articles have the most clicks and ad revenue.

Automate the Process:

- Use tools like Google Analytics to track your traffic and revenue.

- Set up automatic advertising campaigns in the selected traffic networks.

- You’re constantly testing and adjusting your ads and content for better results.

For me, the key is to start small, to learn first. Once you understand how traffic arbitrage works with a blog, you can grow by buying more traffic and creating more blogs.

This method, although it takes a lot of study and effort at first, can turn into a significant passive income if you remain consistent and constantly improve your strategies.

6. Collection of Rights

Another popular method of passive income is the collection of royalties from various products such as e-books, online courses, music, video clips, photos, graphics, etc.

Let me explain better:

- If you make a series of video tutorials explaining how to grow tomatoes and post it on Udemy or Coursera then whoever buys it, you get royalties.

- If you start creating eBooks – using tools like Fiverr and Sqribble – on various topics you own and post them to the Amazon Kindle Store, then you’ll earn royalties.

- If you take nice photos then you can upload them to the dozens of photo banks that exist and when someone uses them, you can collect royalties.

If you do a little research on the internet you will find many platforms where you could upload your work and get paid when someone wants to use it.

Watch this video of someone making design books with artificial intelligence and uploading them to the amazon Kindle Store.

7. Affiliate Marketing With Discount Coupons

Affiliate marketing is a method of promoting third party products – usually via the internet. In essence, imagine that you are a salesperson for a company that has no basic salary and only pays you with commissions.

Of course affiliate marketing is not only done through websites. It can also be done through other methods such as.

How does it work?

There are programs that offer you discount codes to use in your various promotions.

Some of these programs offer you codes that never expire and are linked to your account. If someone uses the discount code to save money without having to click on your affiliate link , you get paid.

This allows you to post the discount code once and once it never expires you never have to post it again.

Internet users searching for “[“brand name discount code” will find your posts, use the code, get their discount and you get your commission.

The more discount codes you post in the more places on the internet, the more you increase your chances of getting a passive discount. 10 discount codes published on 10 websites = 100 chances.

But how passive is all this…

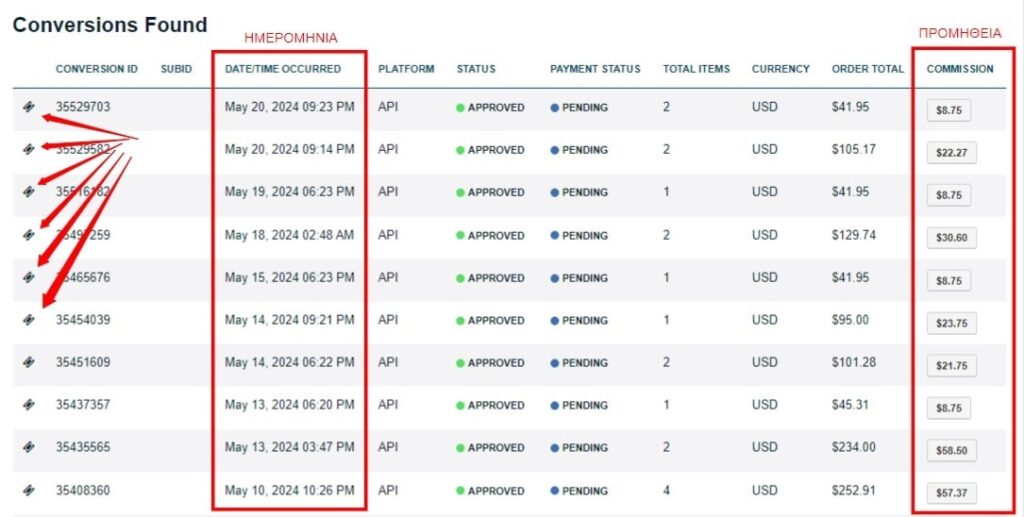

This is a screenshot of one of the programs I’m affiliated with. The arrows point to an icon. This means that the transaction was created through a coupon.

The first column shows the date of the transactions… As you can see… every 2-3 days you create a sale.

The second column shows my supplies..

This passive income comes from actions I took 6 – 7 months ago.

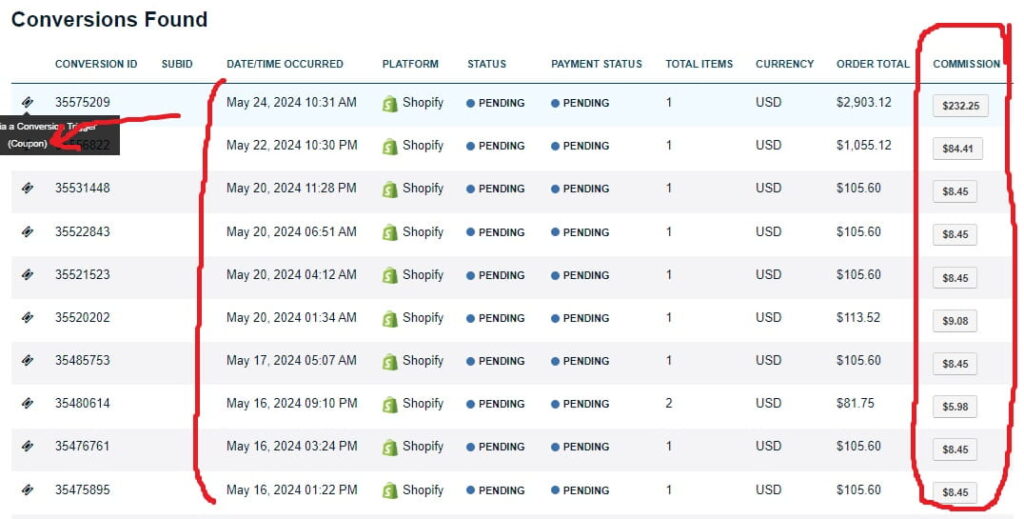

Here’s another screenshot from another program I’m a partner in… Again, look at the icons, dates and supplies.

8. Share your Internet

I’m sure it sounds strange to you. How can someone share their Internet and make money?

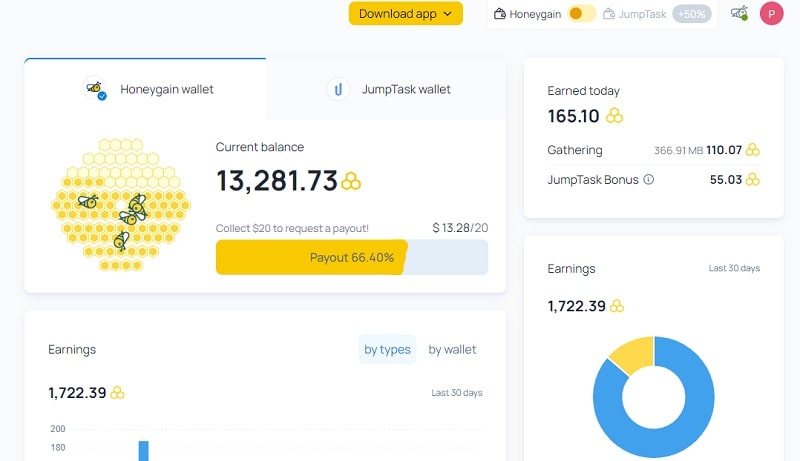

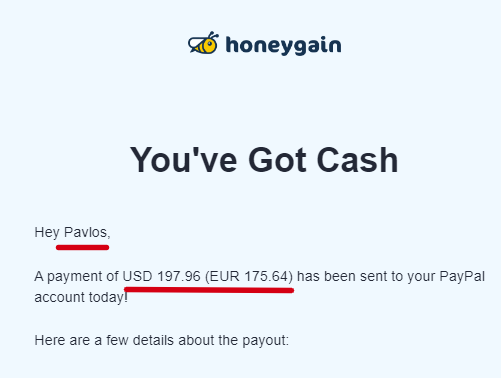

There’s a service called Honeygain that lets you share your unused internet connection data with world-renowned companies to access the world wide web without having to worry about restrictions or censorship based on their location.

For this service, you are paid for it without doing anything at all and without running any risk.

Although you won’t earn thousands from Honeygain, you can earn around €5 – €15 per month – 100% passive income.

Simply download the app to your mobile phone and your personal computer (and your tablet if you want) and let them run in the background, without consuming data or making your device slower.

The money you make from Honeygain can be used to pay for a subscription, your phone or anything else.

You can increase your revenue by referring friends and acquaintances through the affiliate program and start earning an additional 10% on your referral revenue, for life, without any cost on the part of your friend.

You can register here, and get your first €5 euros for free.

I have written a separate article specifically about this method where I recommend other websites like Honey Gain. You can see it here.

10. Earn interest on your cryptocurrency

NEXO is like a digital bank for your cryptocurrencies. You deposit your cryptocurrency into your NEXO account and it immediately starts earning interest. It’s like putting money in a savings account, but instead of dollars or euros, you use Bitcoin, Ethereum or other cryptocurrencies.

Here’s how it works:

- Create an account: you need to create a NEXO2 account.

- Deposit crypto: Then transfer the cryptocurrencies to your NEXO account. You can also buy or exchange cryptocurrencies directly on NEXO.

- He earned interest: Once the cryptocurrency is in your account, it will start earning interest. Interest is paid daily, which means your money grows a little bit each day.

That’s it! Now you earn passive income with your cryptocurrency.

But how much do you have to invest to earn 100 euros a month?

NEXO offers different interest rates depending on the type of cryptocurrency you have in your account.

For example, you can earn up to 8% per year on cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) and up to 12% per year on stablecoins like USDT, USDC.

Now, let’s see how much you need to invest to earn 100 euros per month.

Suppose you invest in a stablecoin like USDT to receive the maximum interest rate of 12% per year. To earn 100 euros per month you would need to invest 10,000 euros.

Final Take

So, what do you think? I’m sure there are many other ideas for passive income, which I may write about in another article.

But of the passive income ideas here, which ones do you think you can start studying today?

If you want more ideas for making extra money from the internet, check out these articles:

👉 Aκολούθησέ με στο Facebook και ενεργοποίησε τις ειδοποιήσεις για να λαμβάνεις τα νέα άρθρα μου.